How Copy Trading Works

1. Create Your Account

Sign up with a regulated and secure trading platform.

2. Choose a Trader

Select a professional trader based on their verified performance history and track record.

3. Automatic Copying

Every trade they make is instantly replicated in your account—automatically and in real-time.

Why Choose CopyTraders.com

- Handpicked Professional Traders

We exclusively feature traders with a minimum of 2 years of proven success and consistent results. - Full Transparency

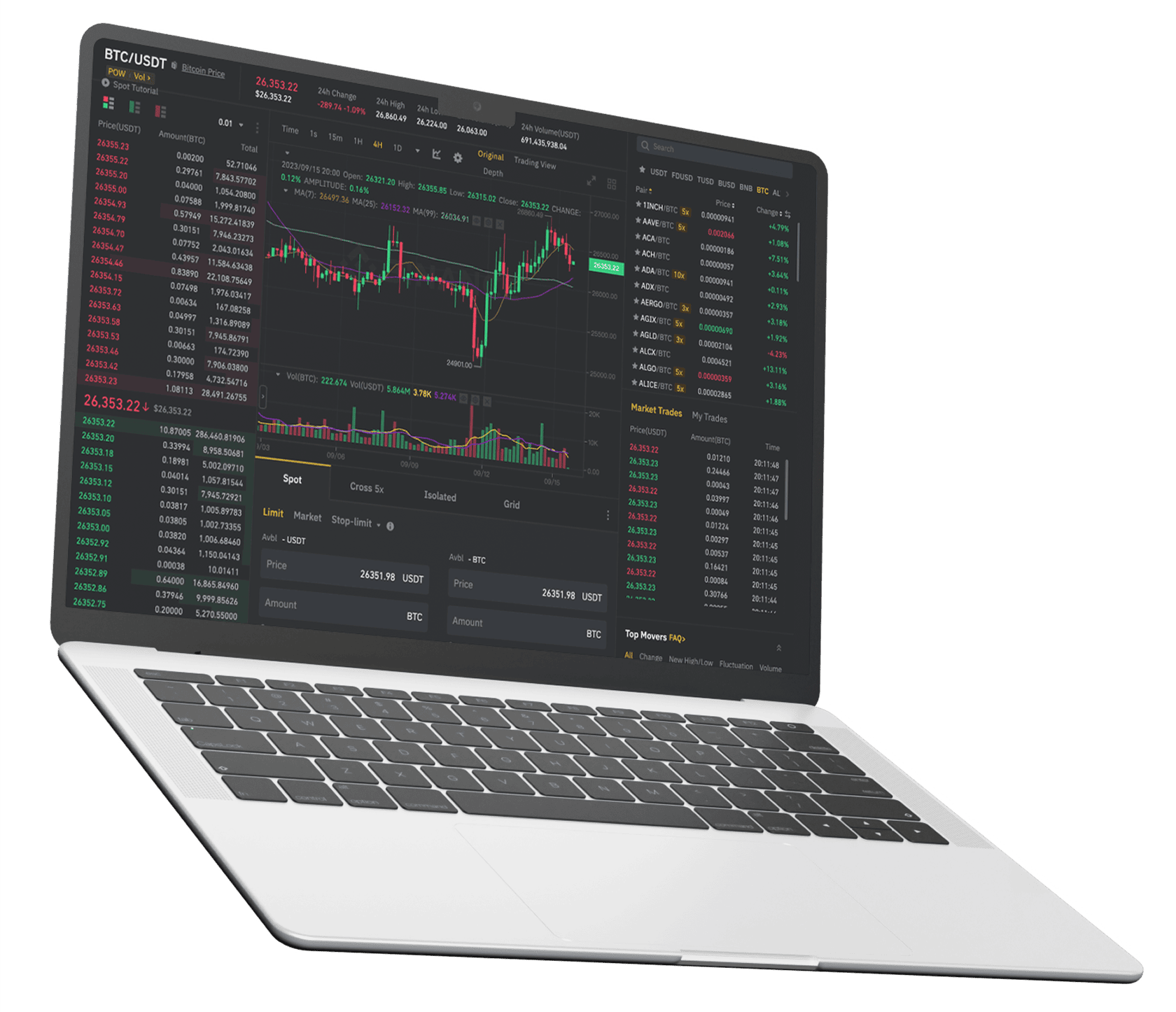

Access detailed performance metrics and risk profiles for each trader before making your choice. - Secure, Regulated Platforms

Your investments are managed through licensed and trustworthy institutions. - Complete Control & Flexibility

Pause, switch traders, or withdraw your funds anytime—it’s entirely up to you. - Fully Automated Process

Once set up, everything runs on autopilot. No need for constant monitoring. - 24/7 Human Support

Our dedicated team is always here to assist you—no bots, just real people ready to help.

It's this easy

Frequently Asked Questions

We’re here to help.

Starting something new often comes with questions—that’s completely normal.

Feel free to ask us anything, anytime. No pressure, no commitments.

We want you to feel confident before you begin—and comfortable every step of the way.

Copy trading is a service that allows you to automatically invest your money by replicating the trades of professional traders—no prior experience or market monitoring required. It’s commonly applied in Forex trading, involving currency pairs like EUR/USD, as well as other financial instruments such as gold.

The core idea is to predict whether a currency pair or asset will rise or fall in value. For instance, if you ‘buy’ euros and the euro appreciates, you profit. Similarly, if you ‘sell’ gold and its price declines, you also gain.

Each trade (buy or sell) is essentially a bet on the market’s direction: the more accurate the prediction, the higher the potential profit.

However, managing this on your own requires:

- Daily market monitoring

- Experience and knowledge of financial markets

- Understanding of technical analysis

- Time and composure

This is where copy trading comes in: a professional trader handles all of this for you. You simply select a trader to follow. Through secure and regulated platforms, your account automatically mirrors the trades of your chosen trader, yielding the same results.

No experience needed.

No decision-making required.

Just choose, monitor, and build passive income

Like any investment, copy trading involves risk. There are no guaranteed profits, and a trader’s past performance doesn’t ensure future results.

However, at CopyTraders, we partner exclusively with platforms that are fully secure and regulated, boasting over 20 years of presence in the industry and licenses from recognized financial authorities.

This means that:

- Your funds remain in your own account; they are not managed by a third party.

- The platforms are supervised and regulated by official bodies.

- There are risk management tools you can configure yourself, such as:

- Stop-loss (the maximum amount you’re willing to lose)

- Automatic cessation of copying if a certain limit you set is exceeded

This way, you have complete control over how much risk you take on, depending on your profile and comfort level.

Copy trading isn’t “blind copying.” It’s an investment tool with protective mechanisms when used correctly.

The minimum amount needed to begin copy trading depends on the specific trader you choose to follow. Each trader sets their own “minimum balance”—the least amount you should have in your account to effectively and safely copy their strategy.

Typically, this minimum starts at around $300. Some traders may accept as low as $200, while the average ranges between $300 and $500.

This threshold exists to protect your investment. The trader determines this amount based on their strategy to ensure that copying their trades in your account is done accurately and securely, without distorting the strategy’s structure or increasing risk.

There’s no universal minimum for all traders. The required amount solely depends on the strategy of the trader you decide to copy.

Let’s break it down in simple terms:

What is Lot Size?

Lot Size refers to the volume of a trade in trading. In simple terms, it’s how “big” or “strong” each trade is. The larger the Lot Size, the more significantly your profit or loss is affected by market movements.

For example:

- If the market moves in your favor, a larger Lot Size results in greater profit.

- If the market moves against you, the same Lot Size leads to a larger loss.

In practice:

- A 0.01 Lot corresponds to approximately $0.10 per pip (a unit of market movement).

- A 0.10 Lot corresponds to approximately $1 per pip.

- A 1.00 Lot corresponds to approximately $10 per pip.

So, if you open a trade with 0.10 Lot and the market moves 20 pips in your favor, your profit is about $20. If it moves against you, the loss is about $20.

In Copy Trading, the system automatically adjusts the Lot Size in your account based on your available capital. For instance, if the trader has $1,000 and opens a trade with 0.10 Lot, and you have $2,000, the system might open a 0.20 Lot trade for you—so you achieve similar results to the trader.

What is Ratio Correction (or Max Lot Control)?

Ratio Correction is a setting that allows you to define the maximum Lot Size that can be opened in your account.

Example:

If the trader opens a large trade, say 0.80 Lot, but you’ve set a limit at 0.50, the system will automatically adjust the trade size to 0.50 Lot—to protect your account.

This way, you have control over the maximum risk exposure in your capital.

What is Scale Down and Skip?

When you set a limit on the Lot Size (e.g., 0.50), you can choose what the system should do if the trader attempts to open a larger trade:

- Scale Down:

The trade will still be opened, but with a smaller Lot Size, as per your defined maximum (e.g., 0.50).

It’s like the system saying: “Okay, I’ll follow, but with less risk.” - Skip:

The system will completely skip this trade. It won’t open anything because it exceeds the limit you’ve set.

In simple terms:

- Lot Size indicates how “big” a trade is.

- Ratio Correction helps you limit risk.

- Scale Down automatically adjusts the trade size to your limits.

- Skip ignores trades that exceed those limits.

And even if all this seems complex, don’t worry. There are detailed step-by-step videos explaining these settings clearly—so you feel completely comfortable before starting.

Yes — you have full control over your funds at any time.

Copy Trading is non-binding. You can:

- Stop copying a trader whenever you wish.

- Switch to a different trader if you’re not satisfied.

- Withdraw your funds, either partially or in full.

Your money is always held in an account under your name, within regulated and secure platforms, and no one else has access or control over it.

There are no hidden “locks” or conditions for withdrawing your capital.

You decide when to start, when to stop, and what to do with your money.

That’s where our team comes in.

At Copytraders, we don’t leave the selection of a trader to chance—we’ve already done the work for you.

Our team searches for and evaluates traders from around the world through events, partnerships, and connections with the brokers we trust.

Before we recommend a trader, we:

- Check their track record (performance, consistency, strategy)

- Test them in practice with real accounts

- Monitor their behavior under different market conditions

This way, we create a curated list of selected traders, which we continuously update.

For each trader we recommend, you’ll find:

- Detailed statistics

- The proposed strategy

- Recommended settings (limits, risk management settings, etc.)

- Risk assessment (low, medium, or high)

This approach allows you to easily choose the trader that suits you, based on your style and the level of risk you’re comfortable with.

Important Note:

The traders we recommend are the ones we have personally tested and monitored, but that does not mean they are the only good traders — or the best ones — available on the platforms.

There are hundreds of other traders you can explore on your own by reviewing their performance history and stats.

The final choice and responsibility for which trader you copy is always yours.

It’s simple: you don’t pay anything to start, to monitor, to choose traders, or to stop whenever you wish. There are no subscriptions, commitments, or hidden fees. You start and stop at your discretion, with complete freedom.

As a team, we are passionate about Copy Trading and, in general, about discovering smart investment methods that come with no participation costs. We achieve this through our collaboration with traders and platforms that operate on a performance fee model.

What does this mean in practice?

Each trader you copy isn’t paid directly by you, nor through a monthly fee. Instead, they take a percentage of the profits you earn—and only when you’re profitable.

This percentage (performance fee):

- Is set by the trader themselves

- Typically ranges between 15% and 30% of your net profits

- Is automatically handled by the platform—you don’t need to do anything

When is this percentage taken?

It depends on the trader you choose:

- Some deduct it daily (at the end of each day)

- Others weekly (at the end of each week)

- Some monthly (at the end of each month)

But there’s one fundamental rule:

If your account is at a loss, nothing is deducted. The trader doesn’t receive any payment until they bring you back to profitability—and cover any previous losses. Only when you’re genuinely in profit does the performance fee apply.

In simple terms:

You profit, and the trader profits alongside you. This is the fairest and most transparent way to collaborate—and that’s why we choose it.